Payment gateway integration is the process of seamlessly connecting a website or mobile application with a trusted payment gateway service provider, enabling secure online transactions. This allows customers to make payments using credit/debit cards, digital wallets, or net banking during the checkout process.

Businesses can choose between two primary methods:

Hosted payment gateway integration, where customers are redirected to a secure external payment page, and API-based payment gateway integration, which enables direct, on-site transactions for a more streamlined and branded user experience.

Online Payment Integration to Website: Single/multiple Payment Gateways

At Tomsher, we specialize in delivering reliable and secure payment gateway integration services tailored to your business needs. Whether you operate an eCommerce store, a subscription-based platform, a marketplace, or a service-focused website, our customized payment gateway solutions ensure smooth processing, secure transactions, and optimal user satisfaction.

As a trusted payment gateway company in Dubai, we partner with leading global and regional providers to offer flexible, scalable, and fully compliant integration solutions that support your business growth and enhance your digital payment infrastructure. A modern payment gateway plays a key role across various industries and use cases. For e-commerce, it enables seamless checkout and fraud-protected transactions. For subscription services, it supports recurring billing. In multi-vendor marketplaces, it ensures smooth fund distribution. Gateways are also essential for online learning, event ticketing, on-demand services, digital downloads, and mobile apps. We also integrate Buy Now, Pay Later (BNPL) solutions such as Tabby and Tamara, which allow customers to pay in installments—boosting affordability and increasing sales for merchants. We integrate a wide range of powerful and trusted payment gateways to match your business model. These include Tap, a mobile-first solution offering smooth checkout experiences across the GCC, and Network, one of the UAE’s largest processors offering secure and scalable payment infrastructure. For multilingual and multi-currency needs, we offer CCAvenue payment gateway services, commonly used across India and the UAE. We support PayTabs payment gateway integration, optimized for MENA region businesses, and Magnati, known for secure, locally compliant hosted and API options.

For businesses targeting a global audience, we provide Stripe payment gateway integration with advanced APIs, PayPal for trusted international transactions, and Adyen, a unified commerce platform used by global enterprises. Telr offers a budget-friendly option for UAE-based startups and SMEs, while Amazon Payment Services (Payfort) delivers robust solutions for scalable eCommerce businesses. We also offer Checkout payment gateway integration for enterprises seeking advanced processing capabilities, Mamo Pay for mobile-friendly and SME-focused solutions in the UAE, and Cybersource, a Visa-backed platform known for strong fraud protection. For merchants tied to the local Noon ecosystem, we integrate Noon Payments, enabling seamless transactions within the region’s growing e-commerce landscape. As one of the most experienced payment integration providers in the region, Tomsher delivers API-based paymentintegration, tailored checkout experiences, marketplace payment solutions, and secure digital payment infrastructures—ensuring your business is ready for the future of commerce.

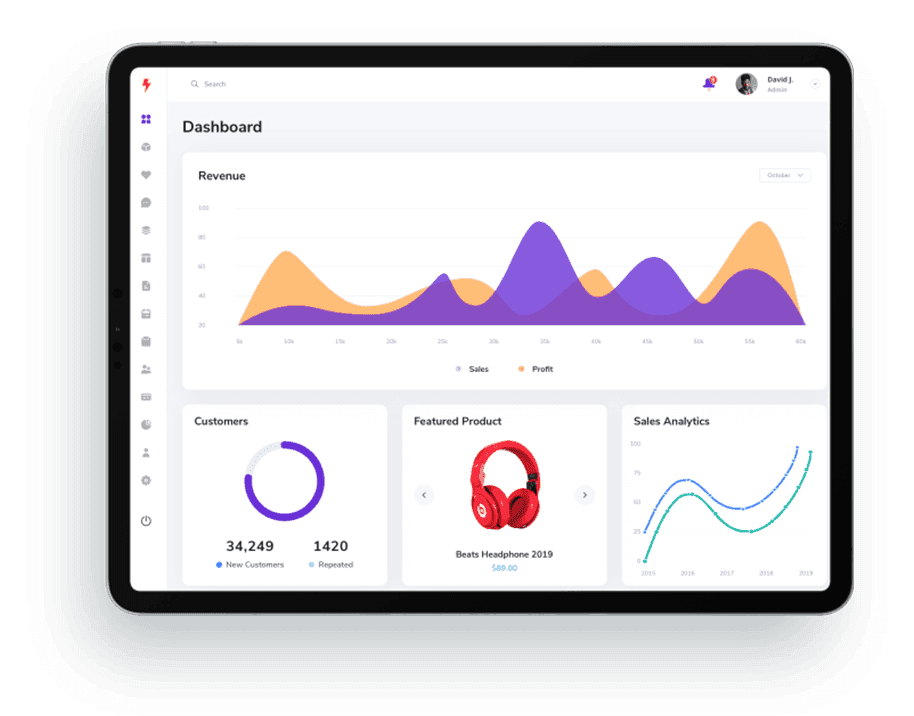

Benefits of Online Payment Gateway Integration

Payment Integration process

The integration process is generally divided into four main stages.

Integration Requirements Definition

The first step of the process is to define the requirements for integration. This involves making decisions about the technical requirements of the integration, such as the payment methods and currencies to be supported, the type of integration (API, web-based, etc.), the security measures that must be taken, etc.

System Configuration

The next step is the configuration of the payment gateway solution. This includes setting up the payment gateway system, linking it with the eCommerce application, and configuring the payment methods, currencies, and other features that were decided upon in the previous step.

Integration Testing

Once the payment gateway is configured, the next step is to perform integration testing. This includes testing the payment gateway’s functionality, such as the ability to process payments, the security measures taken, and other features.

Go-Live

The final step of the integration process is to go live. This involves making sure that all the necessary components are in place and that the payment gateway is ready to accept payments from customers. Once the go-live is complete, the payment gateway is ready to be used.

Payment Gateway Integration Services